14 Mar Things to Remember When Markets Fall

In response to the recent market downturns, there are number of ‘Things to Remember When Markets Fall’ to help cut-through the noise and achieve your long-term investment plans.

Headline Index Falls vs. Client Falls

We will be reading some scary numbers on the news and online. Talk of “1,000-point declines” and “FTSE down 8% this morning” is bound to cause concern. But remember that only a minority of advised clients will be 100% invested in shares. At Pocock Rutherford the most popular client risk level is Balanced, where your funds will hold only around 50% in shares. It’s worth remembering some other assets have quietly gone up in the last few weeks, not down. But no headline writer wants to trumpet the fact the government bonds have advanced, because…

The media needs sensation…but clients need patience

Media is competitive. There’s less attention, and therefore less money, in measured and rational commentary than there is in doom and crisis. It is in news editors’ interests to stoke things up. Advisers need to do the opposite: dampen down the fears. Don’t let yourself be pulled this way and that by the whims of front-page headline writers.

Always ‘Pan Out’ Your View of Markets

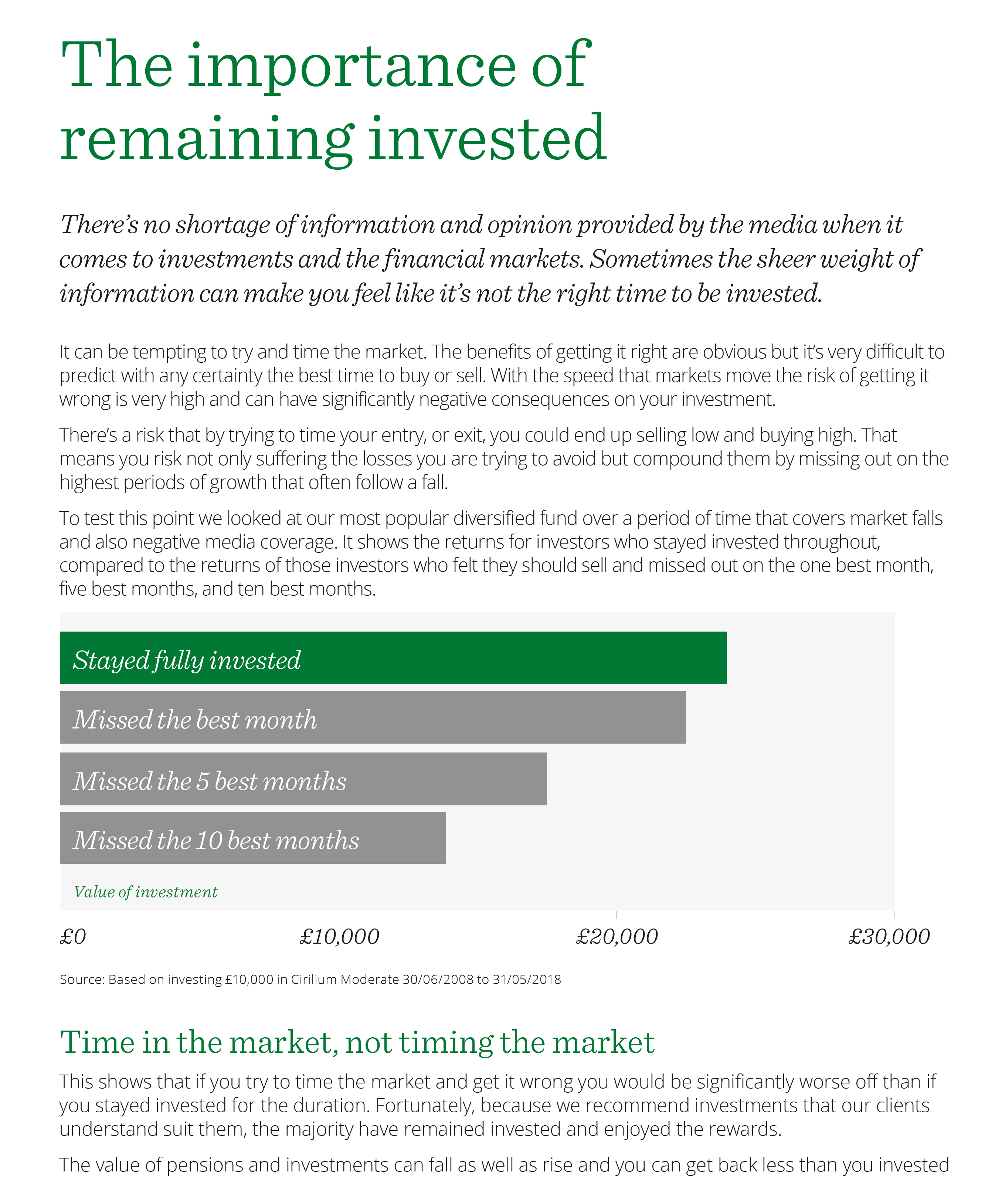

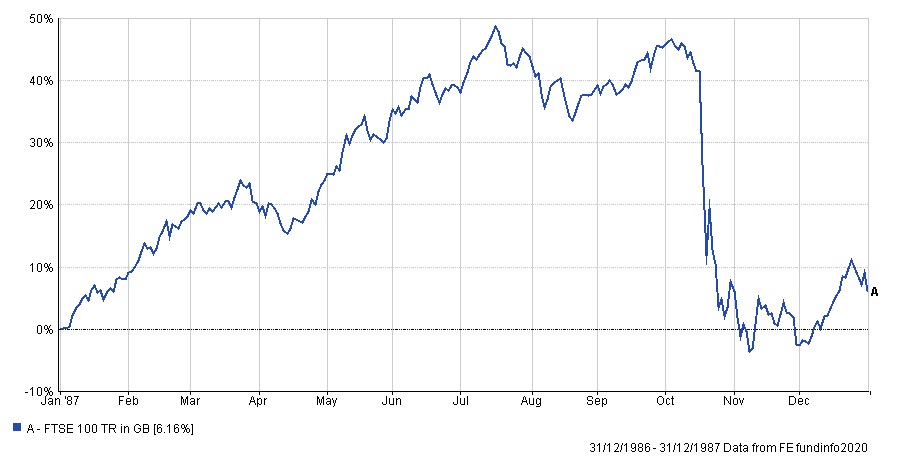

This is the worst FTSE fall in history, from October 1987:

Looks horrible, doesn’t it? But note that the market actually ended that year up by over 6%! The dramatic fall grabbed the headlines and that is what we remember today. The steady 40%+ gains in the first nine months of the year get forgotten.

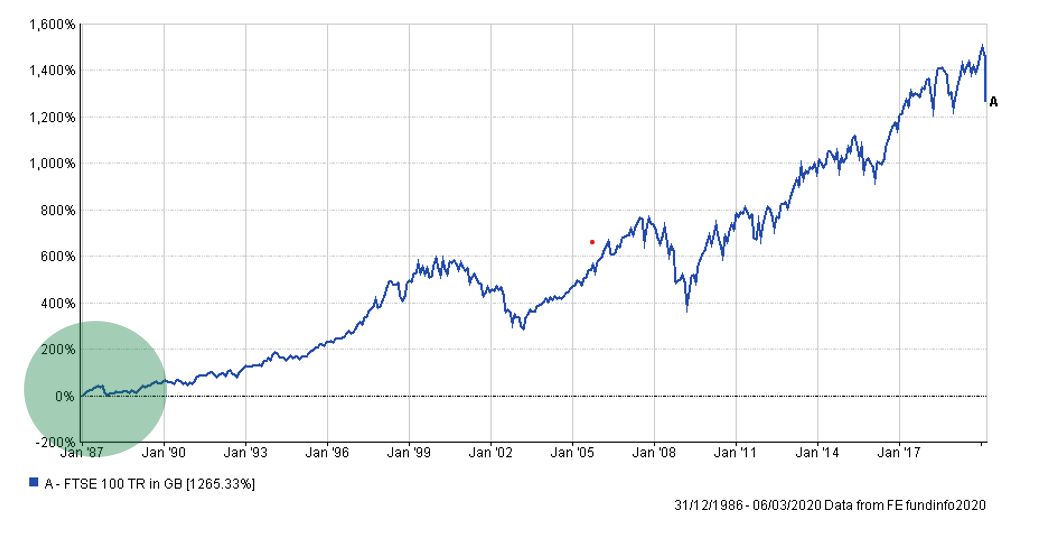

But, much more importantly, here is that same “record” crash on a genuine long-term view:

It’s not much, is it? Hardly a blip. Not worth a panic.

It’s not much, is it? Hardly a blip. Not worth a panic.

Remember Dividends

We also have to remember that, when it comes to shares, prices make all the noise and grab the headlines… but it’s dividends that do the real work. Here is the same long-term FTSE 100 chart from above on both a Total Return basis (Red) and a Price Only basis (Blue):

You can see that the Price Only return (the return to the investor from capital appreciation in the index alone) is 284.9%. The Total Return, which includes the impact of reinvesting dividends, is 1265.33%. The difference is massive. And yet we seldom hear about equity dividends on the news.

You can see that the Price Only return (the return to the investor from capital appreciation in the index alone) is 284.9%. The Total Return, which includes the impact of reinvesting dividends, is 1265.33%. The difference is massive. And yet we seldom hear about equity dividends on the news.

Don’t Try to Time It

We all wish that we were clairvoyant. We’d sell just before the dips, buy just before the rises, and wallpaper our castles with £50 notes. But we can’t do that, because markets are unpredictable by their nature. Investors get paid, over the long term, a premium over risk-free assets as a reward for bearing uncertainty. If it were possible to get the returns without the uncertainty, then everybody would do it and the return premium would be arbitraged to zero.

You can’t do what’s right for your portfolio by pretending to know exactly when to be ‘in’ or ‘out’.

The Economy is Still There

Coronavirus is very worrying, and the global attempt to mitigate its spread is going to slow down activity for a while. It’s not so much the virus itself that is causing market falls, but the constraints on human activity that follow it.

But beneath these legitimate concerns lies an economy still functioning, demand still present, workers still trained and capable, machinery still turning, minerals still in the ground, holidays still to be taken, bellies to fill, roads to be repaired…everything that we collectively call “The Economy”.

It hasn’t gone away. If it slows down for a bit, it will only come back all the stronger.

What Was The Original Plan?

So, let’s ask the questions that really matter:

- What was your plan when you made this investment?

- What timescale did you put on it?

- What risk level did you agree to accept?

- What part of your life was this investment designed to serve?

- And what part of your plan involved waiting for an opportunity to sell your holdings for a loss?

If you can sell, it means somebody else wants to buy. Don’t let your hard-earned capital be somebody else’s bargain.

Take Advice

Investors need advice now more than ever. Talk to your adviser, who will remind you that this is not the first time that markets have had a bad run, and that they understand how they’re feeling. Take a view on the urge to “take action”, and whether that action be prudent or not.

Taking advice right now, while fear stalks the markets, is advice that will change people’s lives for the better. The DIY investors might be panic selling right now. But you have your Adviser to call upon. They will thank you for being present, being honest, and bringing them back to the plan.